Background Checks Are Top Priority for Landlords, According to Joint Survey from RentRedi and BiggerPockets

Separate RentRedi survey reveals how landlords screen tenants, what they verify, and how property management software is changing the game

/EIN News/ -- NEW YORK, May 20, 2025 (GLOBE NEWSWIRE) -- A new joint survey from RentRedi, the fastest-growing DIY landlord software that makes renting easy for both landlords and renters, and BiggerPockets, the largest online community for real estate investors, reveals that background checks are the most important tool in a landlord’s screening process. These results, paired with a companion survey conducted by RentRedi alone, provide new insights into how landlords conduct tenant screening and how many use technology to strengthen their approach.

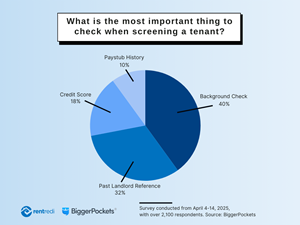

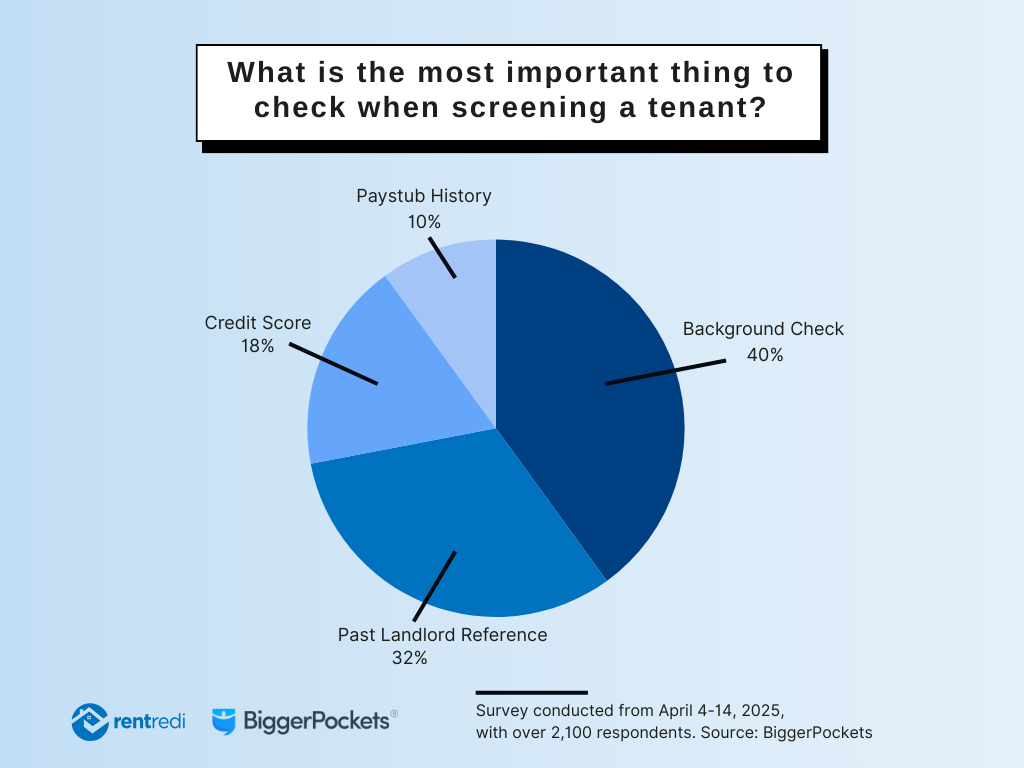

BiggerPockets surveyed its members from April 4-14, 2025 about the most important thing to check when screening a tenant. Of the 2.1K respondents, nearly half said background checks were the most critical factor when evaluating a tenant, followed by a third who pointed to references from previous landlords. Less than a fifth ranked credit scores as the top priority, while 1 in 10 said they rely most on paystub history.

RentRedi ran a separate survey almost simultaneously from March 30 to April 14, 2025, garnering responses from nearly 700 landlords, revealing that most landlords are taking a multi-layered approach to tenant screening. A full 88% of respondents said they run a certified tenant screening report, while 78% said they reach out to references and 61% said they review applicants’ social media profiles. In fact, half of all landlords surveyed said they use all three methods, suggesting a growing recognition that no single data point tells the whole story.

Verification also plays a central role, with 91% of landlords saying they verify an applicant’s employment, while 90% confirm income, 84% check references, 82% verify credit scores, and 78% look into rental history. More than 60% reported verifying all of these details before making a leasing decision, highlighting just how rigorous the screening process has become for many independent landlords.

RentRedi’s survey demonstrates that landlords aren’t solely focused on finances, however. Many are also vetting applicants for lifestyle compatibility. Eighty percent said they want to know about a tenant’s pets, while 69% are concerned with smoking habits. Forty percent said recreational drug use was an important factor to understand, and 29% wanted to know whether tenants planned to host parties—and how often. A quarter of respondents said they try to gather information on all of these lifestyle preferences when screening.

“Landlords don’t just want tenants who can pay rent—they want tenants who will take care of their property and be a good fit for their rental,” said RentRedi Co-founder and CEO Ryan Barone. “These surveys show that background checks and references are essential, but they also show that landlords are digging deeper and leaning on software like RentRedi to make more informed, more efficient decisions.”

When it comes to prequalifying prospective tenants, 59% of landlords said they rely on property management software, compared to 43% who still screen manually through phone calls, emails, and texts. Just 12% said they use a third-party property manager, and only 3% reported using a combination of methods.

More than two-thirds of landlords use software to electronically verify at least some of tenant documents such as paystubs and bank records, while a quarter of respondents still request physical documentation. Notably, 8% admitted they do not verify any tenant information, a gap that highlights the continued need for accessible tools and education.

These findings show a clear trend: landlords are increasingly using property management software to screen applicants with greater precision and efficiency. RentRedi’s 5-pronged tenant screening process, which includes evaluating background checks, credit reports, criminal records, eviction history, and financial stability through income and asset verification, directly aligns with the priorities of landlords.

As the rental market continues to evolve, technology is playing a larger role in helping independent landlords mitigate risk and maximize their investment. These surveys confirm that a thorough screening process, backed by RentRedi’s tenant screening software, can lead to stronger tenant relationships, lower turnover, and fewer costly surprises.

In both surveys, percentages have been rounded to the nearest whole number. The full survey results can be found here.

About RentRedi

RentRedi offers an award-winning, comprehensive property management platform that simplifies the renting process for landlords and renters by automating and streamlining processes. DIY landlords can quickly grow their rental businesses by using RentRedi's all-in-one web and mobile app for rent collection, market listings, tenant screening, lease signing, maintenance coordination, and accounting. Tenants enjoy the convenience and benefits of RentRedi’s easy-to-use mobile app that allows them to pay rent, set up auto-pay, build credit by reporting rent payments to all three major credit bureaus, prequalify and sign leases, and submit 24/7 maintenance requests.

Founded in 2016, RentRedi is VC-backed and a proven leader in the PropTech market. The company ranks No. 180 on the Inc. 5000 list and No. 13 on the Inc. 5000 Regionals list. It was also named an Inc. Power Partner in 2023 and 2024, and to Fast Company’s Next Big Things in Tech list in 2024, as well as HousingWire’s Tech100 list in 2025. To date, RentRedi has more than $28 billion in assets under management with nearly 200,000 landlords and tenants using its platform. The company partners with technology leaders such as Zillow, TransUnion, Experian, Equifax, Realtor.com, Lessen, Thumbtack, Plaid, and Stripe to create the best customer experience possible. For more information visit RentRedi.com.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/79afc9f2-2d5a-42c4-89e7-be70312143e6

https://www.globenewswire.com/NewsRoom/AttachmentNg/ad8082eb-4e4d-43c7-8817-0f3c801dbb1f

RentRedi Media Contact:

Jennifer Tolkachev

jen@rentredi.com

RentRedi and BiggerPockets Tenant Screening Survey

BiggerPockets surveyed its members from April 4-14, 2025 about the most important thing to check when screening a tenant. Of the 2.1K respondents, nearly half said background checks were the most critical factor when evaluating a tenant, followed by a third who pointed to references from previous landlords. Less than a fifth ranked credit scores as the top priority, while 1 in 10 said they rely most on paystub history.

RentRedi Tenant Screening Survey 2025

Verification plays a central role in tenant screening, according to a RentRedi survey. More than 60% of the respondents reported completing a comprehensive list of verifications before making a leasing decision, highlighting just how rigorous the screening process has become for many independent landlords. Many landlords also gather information on a variety of lifestyle preferences when screening renters.

Distribution channels: Business & Economy, Companies, IT Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release